A. Match the formal phrases on the left with the informal phrases on the right.

|

1 I deposited some money. 2 I withdrew some money. 3 The funds have been transferred. 4 My account is overdrawn. 5 It’s paid by standing order. 6 My account was debited. 7 My account was credited. 8 I used an ATM. 9 I made a balance enquiry. |

a. The money’s been sent. b. I paid in some money. c. It goes out of my account every month. d. I went to a cashpoint. e. I took out some money. f. I’m in the red. g. I checked my balance. h. It went into my account. i. It went out of my account. |

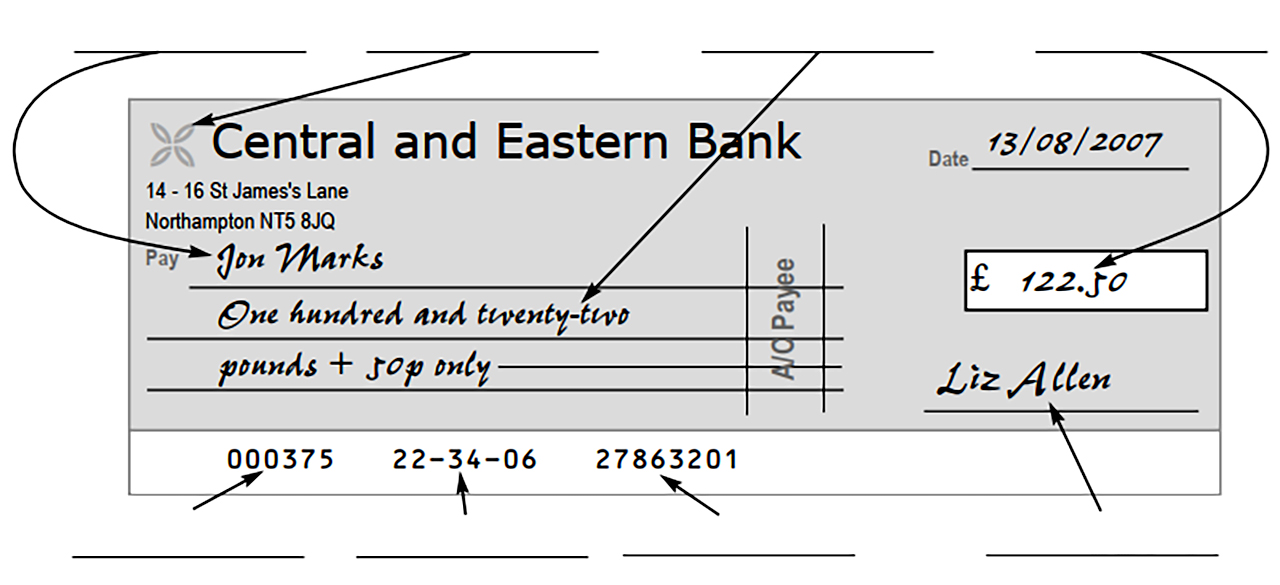

B. Match the words with the parts of the cheque.

account number amount in figures amount in words cheque number

logo payee signature sort code

C. Answer the questions.

1 Who has this cheque been made out to? …………………………..

2 Has it been signed and dated? …………………………..

3 Is it crossed or uncrossed? …………………………..

4 Can it be paid into somebody else’s account? …………………………..

D. Choose the words to complete the sentences.

1 After they have been paid in, cheques usually take three working days to ………………………

a pass

b credit

c clear

2 When I write out a cheque, I keep a record by filling in the ………………………

a receipt

b invoice

c counterfoil

3 If you don’t have a cheque book, you can pay by getting a ……………………… from a branch of your bank.

a banker’s draft

b bank paper

c bank ticket

4 Unlike a personal cheque, a banker’s draft can’t ………………………

a be rejected

b bounce

c crash

5 A banker’s draft is also known as a bank draft or a ………………………

a banker’s cheque

b banker’s note

c banker’s ticket

6 If you need to borrow money, you can apply to your bank for an ………………………

a overdraft possibility

b overdraft facility

c overdraft opportunity

7 If you need to borrow more money from your bank, you can ask them to increase your ………………………

a overdraft limit

b overdraft level

c overdraft supply

8 If you want to borrow money from a third party*, you may have to supply a ………………………

a banker’s support

b banker’s promise

c banker’s reference

9 A banker’s reference proves to a third party that you are ………………………

a moneyed

b creditworthy

c rich enough

10 Regular automatic payments of the same amount (e.g. to a charity) are called ………………………

a standing orders

b direct debits

c direct orders

11 Regular automatic payments of varying amounts (e.g. electricity bills) are called ………………………

a standing orders

b direct debits

c direct orders

12 With my savings account, I have to ……………………… 30 days notice if I want to ……………………… a withdrawal.

a say / do

b give / make

c ask for / take

13 Many employees receive their salaries directly into their accounts by ………………………

a BACS payment

b BATS payment

c BAPS payment

14 BACS stands for Bankers Automated ………………………

a cheque system

b cost system

c clearing system

* “A third party” means another person or company

Answers

A: 1 b, 2 e, 3 a, 4 f, 5 c, 6 i, 7 h, 8 d (also known as a cash dispenser, cash machine and “hole-in-the-wall”), 9 g

B (from left to right): payee, logo, amount in words, amount in figures;

cheque number, sort code, account number, signature

C: Jon Marks, Yes, Crossed, No (because it’s been crossed)

D: 1 c, 2 c, 3 a, 4 b, 5 a, 6 b, 7 a, 8 c, 9 b, 10 a, 11 b, 12 b, 13 a, 14 c